Advance Your OTC Trading with GIFT

Trade Stability, Trust, And Cost-Effectiveness You Can Rely On With GIFT.

What is Over The Counter Trade?

Over-the-counter (OTC) trading refers to a decentralized market where trading of financial instruments takes place directly between two parties, without the supervision of an exchange. This kind of trading is often used for securities that aren’t listed on formal exchanges, commodities, and derivatives.

A few key advantages of OTC trading vs traditional Exchanges are Flexibility, Privacy, Accessibility to financial instruments that may not otherwise be available on other exchanges.

Why OTC Trading Is a Gamechanger

Our team of investment professionals is dedicated to helping you navigate the markets and make informed investment decisions.

Stability Amid Volatility

Gold, which backs GIFT, provides stability in a volatile market, unlike credit-backed currencies.

Trustworthy Trading

Gold’s universal value fosters trust in OTC trades, ensuring reliable transactions.

Regulation Resilience

The universal acceptance of gold allows for smoother transactions, bypassing some regulatory hurdles.

Protection Against Inflation

Gold acts as a hedge against inflation, safeguarding your business during economic flux.

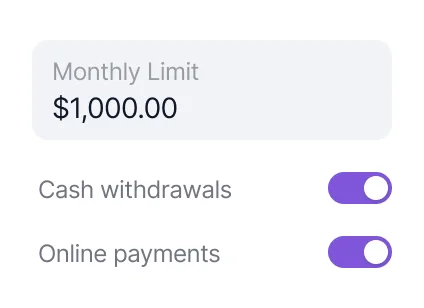

Cost-Effective Transactions

Trading in gold can minimize transaction costs compared to credit-backed currencies.

Avoiding Currency Devaluation And Sanctions

By remitting in gold, you bypass the risk of currency devaluation and potential financial sanctions.

Gold as saving

Good to Know Early - Business Challenges in OTC:

- Lack of Regulation and Counterparty Risk: Oversight in OTC markets can expose businesses to counterparty risks. It’s crucial to conduct thorough due diligence before engaging in any transaction to mitigate this risk.

- Fair Pricing and Transparency: OTC markets can lack transparency, making it challenging to determine fair pricing. Using trusted pricing sources or brokers can ensure you’re getting a fair deal.

- Diversify Investment to Mitigate Liquidity Risk: Some OTC instruments can be illiquid, making them difficult to sell quickly. Diversifying investments can help manage this risk and avoid over-reliance on OTC securities.

- Centralized Clearing House and Operational Risk: Without a centralized clearing house, operational risks like errors in trade execution can occur. Implementing robust operational processes and controls can help manage these risks effectively.

Elevate Your OTC Trading with GIFT

Facing Currency Fluctuations And Inflation Risk? Reserve A Proportion Of Your Wealth In Gold With GIFT And Take Advantage Of The Stable Value Of Gold.